Introduction

Taxes are like the universe - vast, complicated, and make you question everything. Any government's primary revenue source is taxes. All of the benefits and services provided to citizens are made possible by the tax revenue the government collects. A tax is a mandatory financial charge a government imposes on people, corporations, or other legal organisations to pay for public expenses. It is a vital source of funding for several government campaigns, including the construction of infrastructure, the financing of social programs, the provision of defence, and the provision of public services. Taxes come in many different shapes and sizes, including income tax, sales tax, real estate tax, and corporation tax, to name a few. The tax system is designed to be fair, with rates constantly changing depending on income, wealth, or the type of transaction. People and businesses need to understand the basics and regulations of taxes to carry out their legal obligations and contribute to the efficient running of society.

In this blog

First, let's look at the corporate tax bracket

Corporate Income Tax In Nepal (FY 2079/80)

|

Type of Business |

Normal Tax Rate |

|

Normal Business |

25% |

|

Constructing and operating roads, bridges, tunnels, railways, and airports |

25% |

|

Constructing and operating ropeway, cable car, railway, tunnel, or sky |

25% |

|

Special Industry under section 11 for the whole year |

25% |

|

trolley bus or trams |

25% |

|

Entities with export income from a source in Nepal |

25% |

|

Capital market, Securities, Merchant banking, Commodity future market, Securities & Commodity broker |

30% |

|

Money Transfer |

30% |

|

Telecom and Internet Services |

30% |

|

Petroleum business under Nepal Petroleum Act, 2040 |

30% |

|

Tobacco, alcohol, cigarettes, and related products |

30% |

|

Banks and financial institutions (A, B & C Class) |

30% |

|

General Insurance (Non-Life Insurance) |

30% |

Small business management requires creativity, determination, and ambition. These businesses, frequently the backbone of communities, have particular difficulties and chances. Navigating the tax system is a crucial part of running a small business. Employing efficient tax planning strategies is vital to guarantee that few resources are spent wisely.

Small firms can improve their financial situation and make development investments using various tax breaks and incentives. Understanding the complexity of tax planning, which involves employing sharp tax-saving strategies, can help small company owners survive and prosper in this unpredictable environment. Here, we discuss how small businesses can save taxes and flourish.

More on:https://ird.gov.np/public/pdf/1716176355.pdf

Taxation of small company owners presumed

|

Businesses located at |

Tax amount to be paid |

|---|---|

|

Metropolitan City, Sub-Metropolitan city |

Rs. 7500 |

|

Municipality |

Rs 4000 |

|

Rural Municipality |

Rs. 2500 |

However, one must meet the following requirements to qualify for presumed taxes.

- A resident natural person may only get income from their business.

- A business should have an income year with less than Rs. 30 lakhs turnover.

- Under sections 93 and 51, the assessee shall not claim the Medical Tax Credit withheld by the agency as advance tax.

Presumptive taxation of small companies

|

Businesses located at |

Tax amount to be paid |

|---|---|

|

Metropolitan City, Sub-Metropolitan city |

Rs. 7500 |

|

Municipality |

Rs 4000 |

|

Rural Municipality |

Rs.2500 |

Requirements to qualify for presumed taxes

1. A resident natural person may only get income from their business.

2. A business should have an income year with less than Rs. 30 lakhs turnover.

3. Under sections 93 and 51, the assessee shall not claim the Medical Tax Credit withheld by the agency as advance tax.

Turnover-based taxation

The kind of business and turnover determines the tax rate under this technique. Lawyers, physicians, engineers, athletes, auditors, actors, and consultants are examples of people who provide professional services. Still, they must be eligible to use this approach to claim that they have paid taxes. Utilising tax bracket strategies, individuals in these professions can effectively manage their tax liabilities.

Additionally, being aware of the complexities of tax rates enables strategic financial planning. Professionals may maximise their tax status and generate significant savings by carefully managing their resources. It's vital to remember that employing tax bracket techniques successfully depends on maintaining knowledge of the most recent changes to tax rules and regulations. A trained tax counsellor or accountant can offer insightful advice about a client's situation.

Tax bracket methods and small business tax planning give organisations a foundation for deliberating wisely regarding resource allocation, expansion, and investment. They may foresee and reduce possible tax payments using this strategy, which promotes economic growth and stability. In summary, understanding tax bracket tactics equips people and organisations to manage the complexity of taxation efficiently and confidently.

The following rates are imposed for income beyond Rs. 30 lakhs, in addition to presumptive tax.

|

S.N |

Nature of business |

Turnover exceeding 30 lakhs up to 50 lakhs |

Turnover exceeding 50 lakhs up to 1 crore |

|

1 |

Gas and tobacco businesses do transactions with commission or value addition not exceeding 3% on the purchase price. |

0.25% |

0.30% |

|

2 |

Other businesses except those mentioned in S.N.1 |

1% |

0.80% |

|

3 |

Service Businesses |

2% |

2% |

Requirements for turnover-based taxes

1. Resident Natural Person shall only get income from the business.

2. A business should have annual revenue greater than Rs. 30 lakhs but less than Rs. 1 crore.

3. An income year's maximum taxable income (profit) from business is Rs. 10 lakh.

Tax-saving strategies for small businesses

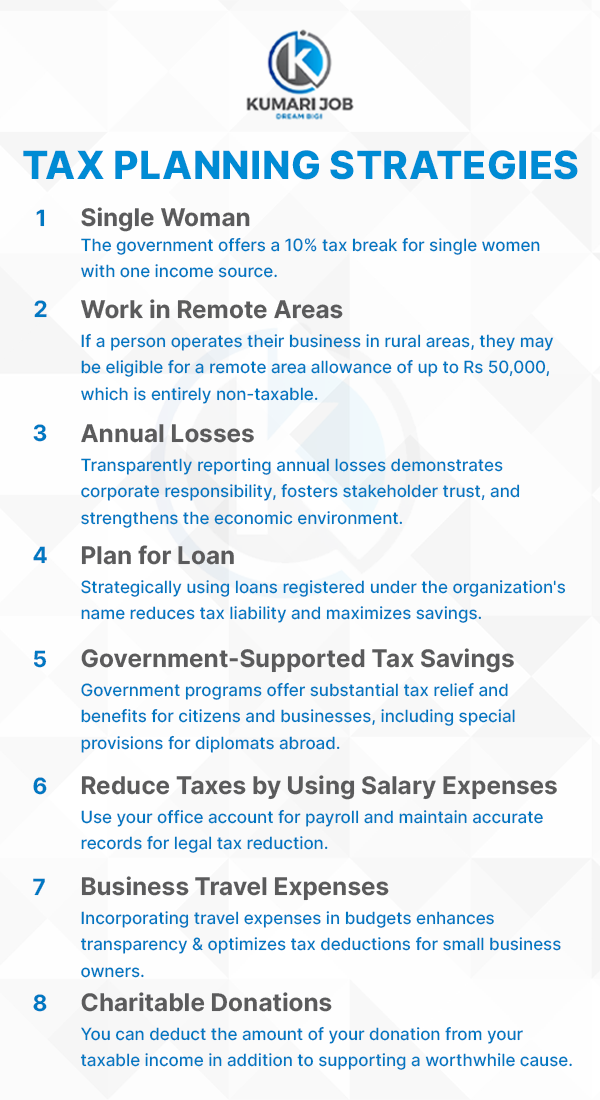

1. Single Woman

The government has a provision that waives 10% of the taxes single women must pay if they only have one source of income. For instance, the government would give you a Rs 1,000 tax exemption if you are a woman and your annual tax obligation is Rs 10,000. This kind of tax benefit showcases the importance of meticulous business tax planning. It underlines the significance of understanding and leveraging tax regulations to optimise financial outcomes for individuals and businesses.

2. Work in Remote areas

In Nepal, tax planning for small business owners is crucial for maximising profits. Understanding the government's classification of districts into rural and urban areas is critical. Tax brackets differ for each, as do potential tax-saving strategies. For instance, if a person operates their business in rural areas, they may be eligible for a remote area allowance of up to Rs 50,000, which is entirely non-taxable. For small business owners, this offers a big chance to maximise their financial results by utilising tax-saving techniques.

3. Show the Annual Losses

A corporation must demonstrate its annual loss in line with regulatory requirements to ensure accurate tax reporting. This openness maintains the company's dedication to compliance, accountability, and tax-saving procedures. By informing the appropriate authorities of a company's losses, we want to manage finances properly and positively affect the more significant economic environment.

Furthermore, this transparent approach aligns with legal obligations and showcases a commitment to ethical financial practices. It sets a precedent for responsible corporate citizenship, fostering stakeholder trust and confidence. By diligently reporting losses, we contribute to a more robust and stable economic ecosystem, ultimately benefiting society.

4. Make a plan for Loan

Contemplating income tax reduction strategies is integral to fiscal prudence. Devising a plan for loans, such as a home or auto loan registered under the organisation's name, is a tricky manoeuvre. Beyond fulfilling business needs, this approach also legally reduces tax liability. You can lower your tax burden by channelling a portion of your income towards loan repayments. This astute financial tactic ensures the optimal utilisation of tax-saving opportunities.

5. Government-Supported Tax Savings: Know Your Options

Hire an experienced accountant to prepare your taxes and execute innovative tax-planning strategies. The government continually implements new programs and incentives to lessen the burden of taxes on its citizens. If you take advantage of all the programs you are eligible for, you may save a lot of money. Nepali diplomats serving in diplomatic posts overseas are entitled to a 75 per cent refund of the additional compensation they get for their job. Additionally, the government provides numerous programs for firms, enabling them to profit from business tax planning strategies catering to their requirements.

6. Reduce Taxes by Using Salary Expenses

Employing efficient small-business tax strategies is crucial if you operate a firm. Pay all of your workers' wages using your office account, and make sure you report these expenses to the relevant authorities. This procedure can assist you lawfully reduce your tax payments and is consistent with advised tax techniques for small business owners.

It's essential to have correct payroll records to comply with tax laws and make wise decisions. Utilising digital accounting systems and consulting a tax specialist helps maximise tax-saving opportunities.

Staying current on tax rules and regulations is crucial because they may change over time. You may gain the most recent information and priceless insights for successfully navigating the complexity of taxes by partaking in events that concentrate on small business tax strategies.

7. Business Travel Expenses

The mention of travel costs in a well-organized budget improves financial transparency and enables wise use of resources. This procedure ensures that business and leisure trips are properly accounted for, maximising the advantages of the available tax deductions, especially for small business owners employing tax planning strategies.

Additionally, for small business owners, coordinating travel expenses with tax planning methods is crucial to good financial management. It maximises tax savings and lays the groundwork for long-term prosperity and growth. By using this strategy, businesses can successfully combine the demands of work and play while maximising the available tax advantages, in line with tax planning strategies for small business owners.

8. Making Charitable Donations

Making charitable donations is one of the most innovative tax planning strategies you can do to reduce your income tax burden. You can deduct the amount of your donation from your taxable income in addition to supporting a worthwhile cause. Keep thorough records of your charity donations to get the most tax benefits. To ensure you may deduct the most significant amount from your taxes, keep track of how much you've donated throughout the year.

Also, remember that not all charitable organisations qualify for the same tax deductions. For instance, contributions to most other charities are tax deductible, but payments to religious institutions are not. Make sure your donation is eligible for a tax break by researching before you make it.

Conclusion

As Chris Rock once said “ "You don't pay taxes--they take taxes."

Small businesses in Nepal have plenty of chances for growth and savings as they navigate the complex world of taxation. A company's bottom line can be considerably impacted by in-depth knowledge of tax brackets and strategic tax planning tactics. There are several ways for small businesses to minimise their tax obligations, from using deductions for expenses to taking advantage of government-sponsored tax planning programs. Additionally, staying current on the most recent tax laws and getting professional assistance ensure that firms remain competitive in this ever-changing environment. Small enterprises can protect their financial security and contribute to the country's economic growth using these tax-saving tax planning measures.

Frequently Asked Questions

As applicable, small businesses in Nepal are primarily subject to Value Added Tax (VAT), Income Tax, and other local taxes.

Small businesses in Nepal can claim deductions for legitimate business expenses, including salaries, rent, utilities, and depreciation of assets. Keep detailed records and consult with a tax advisor for specifics.

Small business owners can employ various tactics such as maximising deductions, utilising tax credits, and structuring their business effectively to minimise tax liabilities and implement small business tax planning strategies. Engaging a qualified tax advisor is essential for tailored advice on implementing these strategies.

Nepal's Inland Revenue Department (IRD) offers formal advice and information on tax-related issues. Additionally, getting guidance from certified tax experts or professionals is advisable.

The Government of Nepal provides specific tax incentives for qualifying startups and new businesses, including tax holidays and reduced tax rates. These incentives may vary based on the industry and location.

0 Comments